Богатите все още продължават да стават все по-богати, но коронавирусната криза може да забави светкавичната скорост, с която трупат състояние, за още години напред.

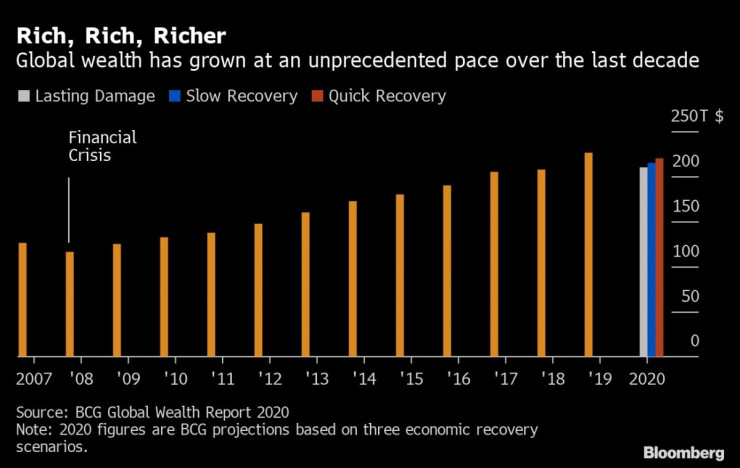

Волатилността на пазарите, както и икономическите последствия от вируса, може да изтрият до 16 трлн. долара глобално състояние през тази година и да застрашат растежа за следващите пет години. Това са заключенията на проучване на консултантската група Boston Consulting Group (BCG). За сравнение това е с повече от 50% над обема от средства, изтрит от финансовата криза през 2008 г. – 10 трлн. долара, посочва Bloomberg.

Продължилата десетилетие бича серия при ценните книжа спомогна на милионерите и милиардерите по света да увеличат състоянието си с двуцифрен темп спрямо хората със средни и ниски доходи. Сега обаче същата тази зависимост от пазарите може да постави богатствата им в риск, ако волатилността заради коронавируса продължи с години.

Личното финансово състояние в глобален план достигна 226 трлн. долара миналата година, което е 9,6% ръст спрямо 2018 г. и най-големият годишен темп на растеж от 2005 г., показват данни на BCG. От 2019 г. до 2024 г. акумулирането на богатство в световен мащаб може да се забави до годишен темп на растеж от 1,4%, ако се изпълнят най-лошите сценарии на BCG. Моделът на групата за бързо възстановяване пък прогнозира темп от 4,5%.

1

1

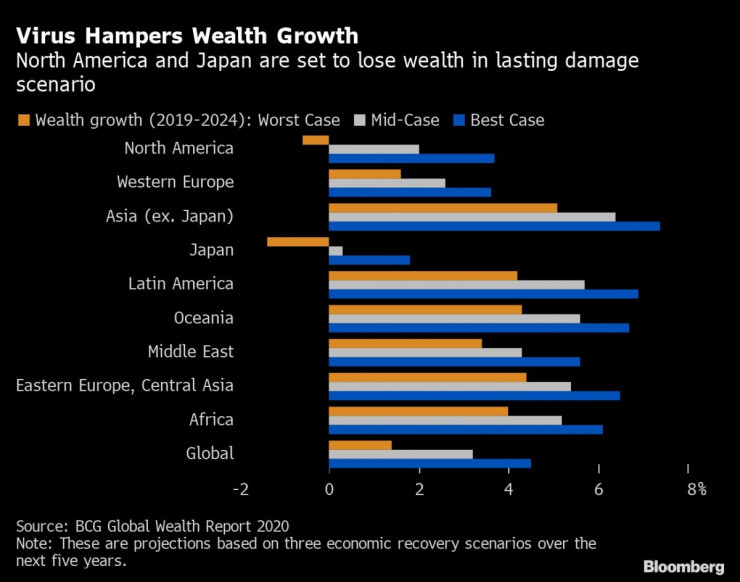

„Сегментът, който ще бъде ударен най-тежко при сценариите с бавно възстановяване и продължителни щети, ще е този на най-богатите, милионерите и милиардерите, заради голямата им експозиция към пазарите на ценни книжа и пазарната волатилност“, посочва Анна Закревски, международен ръководител на звеното за управление на благосъстоянието на BCG, която е и водещ автор на проучването.

Според доклада броят на милионерите в долари в световен мащаб се е утроил през последните 20 години и сега те са 24 млн. души, като две трети от тях са в Северна Америка. Към момента заедно те притежават повече от половината финансово богатство в света. Това от своя страна означава, че при възможно най-лошия сценарий именно Северна Америка ще бъде и най-тежко засегнатата, както и Япония. И двата региона ще отчетат спадове и в рамките на 5-годишния период.

2

2

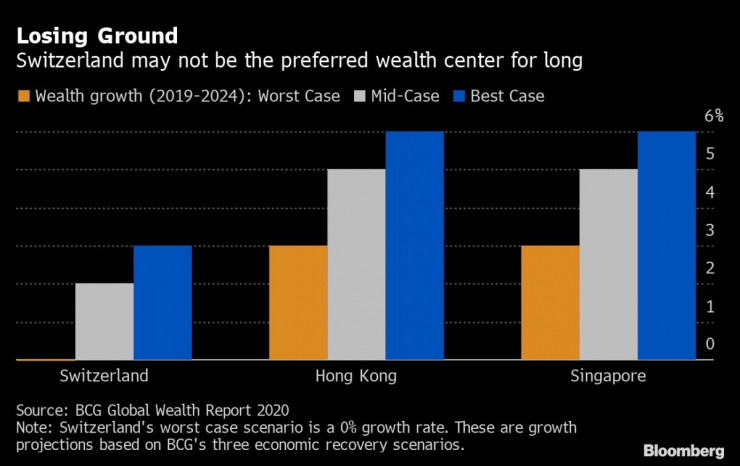

По данни на BCG 9,6 трлн. долара от богатството се съхранява в офшорни сметки през 2019 г., което с 6,4% повече в сравнение с предходната година. Най-голям дял тук има Азия (без Япония).

В краткосрочен план богатите смятат да преместят парите си към утвърдени убежища. В по-дългосрочен план обаче някои може и да ги върнат в страната си на произход, за да си гарантират по-лесен достъп до ликвидност, особено ако негативната тенденция в икономиката се задържи. Това ще е от полза за места като Хонконг и Сингапур заради близостта им до Китай и други бързоразвиващи се пазари в Азия.

И макар Швейцария да остава предпочитаната дестинация за тези, които искат да държат парите си в чужбина, то двата азиатски града бързо наваксват. Очаква се активите, за които те отговарят, да се увеличат двойно по-бързо от тези в Швейцария в рамките на следващите пет години.

3

3

Пандемията може да ускори и необходимата промяна за надзорниците на световните богатства. Мениджърите по управление на благосъстоянието се изправят пред вируса в по-лоша форма, отколкото по времето на финансовата криза – с по-ниска възвръщаемост върху активи и по-високи разходи, отколкото през 2007, посочват от BCG.

„Виждаме Covid-19 като предупредителен сигнал“, посочва Закревски. „Последните 10 години доведоха до доста уверено представяне на мениджърите на благосъстояние и отнеха от напрежението за ангажиране с бизнес моделите“, допълва тя.

Но макар значително по-голямата база от клиенти и активи обемът на печалбата в индустрията остава същият, както преди десетилетие. За 2019 г. той е в размер на 135 млрд. долара спрямо 130 млрд. долара през 2007 г., когато международното богатство бе наполовина на това сега.

Петролът поевтинява, докато Израел претегля отговора на иранската атака

Петролът поевтинява, докато Израел претегля отговора на иранската атака  Износът на Китай за Русия се срива на фона на заплахата от САЩ за санкции

Износът на Китай за Русия се срива на фона на заплахата от САЩ за санкции  Хваната между Иран и Израел, Йордания се тревожи за собствената си стабилност

Хваната между Иран и Израел, Йордания се тревожи за собствената си стабилност  Пауъл сигнализира за забавяне в намаляването на лихвите след инфлационни изненади

Пауъл сигнализира за забавяне в намаляването на лихвите след инфлационни изненади  Ами ако високите лихви на Фед всъщност предизвикват икономически бум в САЩ?

Ами ако високите лихви на Фед всъщност предизвикват икономически бум в САЩ?

Пеевски: България не може да стои без външен министър, президентът да подпише указа

Пеевски: България не може да стои без външен министър, президентът да подпише указа  Със закон в европейска държава забраняват продажба на цигари на родени след 2009 г.

Със закон в европейска държава забраняват продажба на цигари на родени след 2009 г.  Кои храни са богати на витамин Ц

Кои храни са богати на витамин Ц  Борисов: Не обсъждам с Главчев смени на служебни министри

Борисов: Не обсъждам с Главчев смени на служебни министри  105 пожара са ликвидирани за денонощие, жена с изгаряния е приета в "Пирогов"

105 пожара са ликвидирани за денонощие, жена с изгаряния е приета в "Пирогов"

Червен картон? Араухо даже не извърши фаул!

Червен картон? Араухо даже не извърши фаул!  Шави напсува съдията и каза: Не разбира играта, беше катастрофален!

Шави напсува съдията и каза: Не разбира играта, беше катастрофален!  Нова лоша новина за Левски

Нова лоша новина за Левски  Дуо на Левски поднови тренировки

Дуо на Левски поднови тренировки

продава, Тристаен апартамент, 126 m2 Пловдив, Христо Смирненски, 157500 EUR

продава, Тристаен апартамент, 126 m2 Пловдив, Христо Смирненски, 157500 EUR  дава под наем, Двустаен апартамент, 65 m2 София, Студентски Град, 375 EUR

дава под наем, Двустаен апартамент, 65 m2 София, Студентски Град, 375 EUR  дава под наем, Двустаен апартамент, 65 m2 София, Студентски Град, 375 EUR

дава под наем, Двустаен апартамент, 65 m2 София, Студентски Град, 375 EUR  дава под наем, Едностаен апартамент, 60 m2 София, Студентски Град, 350 EUR

дава под наем, Едностаен апартамент, 60 m2 София, Студентски Град, 350 EUR  дава под наем, Двустаен апартамент, 80 m2 София, Дружба 2, 400 EUR

дава под наем, Двустаен апартамент, 80 m2 София, Дружба 2, 400 EUR

Змия в купето забави японски скоростен влак

Змия в купето забави японски скоростен влак  Надал се завърна с победа в Барселона

Надал се завърна с победа в Барселона  Побой над сина на самоковски бизнесмен, в "Пирогов" е

Побой над сина на самоковски бизнесмен, в "Пирогов" е  Сакраменто върви към плейофите, Везенков поигра малко

Сакраменто върви към плейофите, Везенков поигра малко  Едва половината българи ще гласуват на изборите за Европарламент

Едва половината българи ще гласуват на изборите за Европарламент

преди 3 години Богатството ще се изтрие от Печатането на пари от централните банки, не от пандемията. ВИжте по-долу:Banks vindicate ECB's rate cut with biggest-ever liquidity operationThe European Central Bank carried out its biggest ever single injection of liquidity into the eurozones money markets, in an apparent vindication of its move to push interest rates still further into negative territory last month.Banks borrowed 1.308 trillion ($1.47 trillion) from the ECBs latest Targeted Long-Term Refinancing Operation, or TLTRO, the first to offer a rate as low as -1% for banks that meet the ECBs lending criteria (which means nearly all of them). After netting out money that is being shifted from other outstanding ECB loans this week, it still adds up to a liquidity injection of 548 billion euros. The high demand implies that the lower rate isnt as destructive as some had feared with regard to bank profitability. Pictet Wealth Management economist Frederik Ducrozet said it will result in a net transfer of 15 billion euros to the participating banks. The euro was little changed at $1.1248, while sovereign bond spreads tightened modestly отговор Сигнализирай за неуместен коментар